Which business am I? Would you be long or short?

In 2009, I had 2.1 trillion of revenue and 3.5 trillion of expenses, for an operating loss of 1.4 trillion.

For 2010, I’m predicting a small increase in revenues to 2.2 trillion while expenses stay roughly constant at 3.5 trillion. Through heroic efforts, losses will be staunched to only 1.3 trillion this year.

I am guiding to a trillion or so of losses in 2011 and am praying for a turnaround by 2012 so that losses drop to only 700 billion. Naturally, the analysts take our guidance at face value—even though I’m comically incapable of actually predicting results.

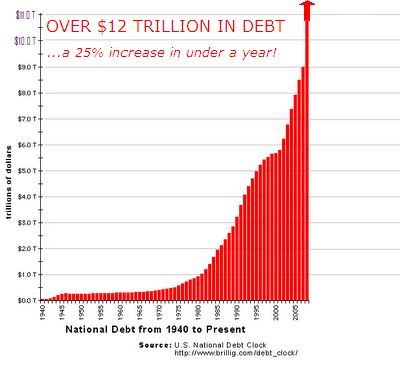

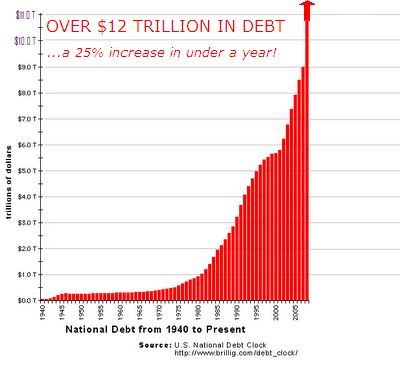

I have about 12.5 trillion in outstanding debt. Fortunately, the patsies that own this are willing to continue rolling it over into other non-covenant debt.

Of course, none of these figures include various off balance sheet liabilities which are dozens of times the size of the recent operating losses. In fact, you can say my accounting for most line items is dubious at best. Fortunately, I do not have to use GAAP accounting. I get to use an archaic system of make it up as you go accounting—where many liabilities and expenses are simply ignored.

None of this includes the various liabilities of my 50 unconsolidated operating subsidiaries (and Guam), which are in theory not guaranteed by the parent—but likely will be if there’s a crisis.

I have a staggered board of 100 super directors and 435 simple directors. The combination of a staggered board and the gerrymandering of who gets to vote almost assures that a proxy battle will be nearly impossible. Like most entrenched and dysfunctional boards, the board members are more interested in creating obscure related party transactions than actually doing their job. These transactions often are akin to looting the company, yet the bylaws of the corporation claim they’re legal.

A new CEO was recently elected with much fanfare, but a year into the job, he’s done little except tilt at windmills. If anything, he seems to just be making bad problems worse. After promising to fix the system and clean house, he essentially reappointed as middle management, the same guys who created mess (Summers, Geitner, Bernanke, Yellen, etc).

The revenue of our corporation is somewhat fixed. It grows at a mostly constant pace based on the growth of economic activity. Therefore, to stop the losses, clear attention must be focused on the expense line items. However, like most empire building CEOs, the new guy is already looking at expensive new uncorrelated businesses (healthcare) and even a potential acquisition (Iran). Good luck trying to integrate that one. The employees at the last 2 acquisitions (Iraq & Afghanistan) have had some differences in culture, to put it mildly.

I could go on. Things sure seem bleak. Rather than fix problems, our dysfunctional corporation is looking for new problems. It’s a much larger version of General Motors—where obvious problems did not matter, until they did.

If you haven’t guessed it yet, this corporation is the US government, and it’s heading for a crisis. Is there hope for this business? Of course there is. My grandfather always told me not to bet against the US. However, like many old companies, until there is a real crisis, change is impossible. No one wants to take the painful steps needed. I don’t think the US is a terminal short, but it will face serious headwinds in the next decade.

For generations, investors have lost money betting on Armageddon. What is different now? I think the sheer size of the budget deficits mean that a problem is imminent. This doesn’t mean it won’t take another five years for there to be a problem. However, as investors begin to recognize the magnitude of the problem, they will slowly begin to act. In fact, they already have started to act.

As it stands right now, even if the government abandons Afghanistan and Iraq, eliminates a lot of pork and seriously tries to make cuts in other places, the budget would be nowhere close to balanced. The government could try to raise taxes, but I see that as being very difficult politically. The government could try and make serious cuts to social programs, but that would likely be even more difficult. Of course, the economy can recover and the government can possibly outrun its deficits—at least for a while—but Social Security and Medicare are the two real elephants in the room. In the next few years, they will simply trample down on any breathing room created by budget cuts.

Budgets do not need to be balanced, but deficits need to be reasonable. Ours are nowhere close—and they will likely get worse as the baby boomers retire. Maybe China will simply finance our profligate budgets forever. Maybe that is just easier for them? I don’t know. I just know that a country cannot run deficits of the magnitude that we are and get away with it for long. There will be consequences.

This is what likely happens; the government finds new and creative ways to waste money. They will try to raise taxes, but it just won’t have much impact. You cannot tax your way out of this problem. You need to cut spending and no congressman will ever vote for that—not yet at least. Eventually, holders of bonds will lose faith in our ability to stop spending. Either they’ll sell their bonds, or simply stop showing up for endless auctions. Who’s going to buy a trillion and change worth of bonds every year? There isn’t enough money in the world to continue this charade forever.

At some point, the bond market will go into freefall and the government will not be able to fund itself. The government will either need to buy those bonds and monetize the debt, or default. A default is unlikely and rather improbable as long as our bonds are denominated in a currency that we can print. Think Argentina.

When we print money, it’s very inflationary. We’ve already started this process. As we have difficulty selling more bonds, we will almost have no choice. You’ve all heard this story before. It’s been wrong for decades. I think it will ultimately be right. Look at gold. It’s up more than four-fold from the lows. I think the real move is just starting. People have finally figured it out.

Yes, gold earns nothing. There’s no interest. No return on capital. You can’t eat it. You even have to pay money to store it. It really should have no value. It’s useless. We all know the facts. However, let’s look at some different facts.

Gold is just another commodity. Let’s ignore the doom and gloom macro aspects of it for now. Treat it like any other commodity—especially because about 70% of end demand is jewelry, industrial and dental. Like all commodities, over time, it should trade at a small premium to production cost to compensate those who produce it and let them earn an adequate return on invested capital. What is the cost of producing it?

If you listen to a mining company, they’ll talk about their cash cost per ounce. For the industry, the cash cost per ounce averaged $450 last quarter. However, this is just a starting point when thinking about the true cost of producing that gold.

Accounting for mining companies is very complex. During the twenty year bear market in gold from 1980 until 2000, mining companies became desperate for investment. They deliberately tried to convince investors that the true costs were lower than they were. For the most part, they seem to have achieved their goals by directing people to focus on the cash cost of gold. If people looked at the real cost, they would have realized that most mining companies were either losing money, or living off past investments and running those investments through the income statement.

So what is the real cost of producing gold? Let’s approach this question in a different way. If I wanted to build a mine from scratch, what would it cost me to mine gold? First, I would have to find some gold to mine. Industry estimates on this topic are very diverse. People find gold all the time. Finding economic gold is much harder. Industry wide, the cost of finding an ounce of gold ranges from $80 to $150 an ounce. The number is so high because so much money spent looking for gold is wasted as nothing is found.

Next, you have to pay for engineering, economic and environmental studies on your mine. This costs around $40 an ounce. It breaks down as; $10 for engineering, $5 for economic and $25 for environmental studies (permitting). You don’t have a mine without permits. Permits also include the schools and hospitals you need to build next to your mine to make the locals happy.

Once this is complete, you need to build your mine. There is a massive discrepancy on how much this costs based on where the mine is located, mine type, ore grade and metallurgy. Building a new mine costs tens and often hundreds of millions of dollars. For really big mines, this figure can be in the billions of dollars. If you divide that figure by the number of ounces the mine will produce over its lifetime, you come to a mine building cost of between $100 and $200 an ounce.

However, you cannot simply build a mine and leave it alone. You need sustaining capital to replace and upgrade equipment. Generally speaking, this will run you $25 to $75 an ounce.

While the popular cash cost figure includes mine employees, it doesn’t include corporate management or the general costs of running a company. I don’t know why this is—but such is the obfuscatious nature of mining accounting. Generally speaking, this will run you another $50 an ounce.

Once you add in the much trumpeted cash cost, you can see what the real cost of an ounce of gold is. All costs are in US Dollars.

| Cost Component |

Low Estimate |

High Estimate |

| Finding Gold |

80 |

150 |

| Engineering, Economic and Permitting |

40 |

40 |

| Mine Building |

100 |

200 |

| Sustaining Capital |

25 |

75 |

| General SG&A |

50 |

50 |

| Total |

295 |

515 |

| Cash Cost |

450 |

450 |

| Actual Cost of Producing and Ounce of Gold |

745 |

965 |

Most mines are debt financed. This $745-$965 an ounce number does not include any interest expense incurred in a mine. It also doesn’t include the cost of continuing community relations or mine closure. I would guess that community relations adds another $10 per oz per ounce and closure costs can be astronomical depending on what sort of contamination exists. There are plenty of other costs not included above.

Normally in economics, when the price of something goes up, more of it is produced. Why has gold production declined from ten years ago—even though the price has continued to increase? The only logical answer is that most producers were not making any money—so they didn’t increase production.

So what price should gold trade at? There is no such thing as a ‘correct price.’ However, it needs to be at least high enough so that the producers make a reasonable profit. Probably a floor price should be something around $1,000 an ounce for most miners to at least cover their cost of capital. Mining is a very risky business. People will not invest significant money into it unless companies are making good money at it. For there to be significant new investment, I think gold prices need to consistently be at least $1,100.

I don’t know what price gold will trade at in the future. However, I know that when some guy on TV says that gold is overvalued because it has gone up a lot in the last few years, he likely has no idea what he’s talking about. Currently, the price of gold is only a little over the price of producing it. Does that sound like an overvalued commodity?

Finally, production costs have continued to increase around 20% a year. This is the result of newer mines being lower grade and more expensive to operate. This will likely continue to be a trend going forward. Throughout history, higher grade ore bodies are mined first. If you look at average grade, it’s declined throughout history. This increases costs—as do higher inputs like energy, permitting and government royalties, which are just another form of taxation. These costs have increased at astronomical rates in the past few years. The price of gold should at least roughly track the increased cost of producing it.

How does this play into a view of the US being on the verge of defaulting? For lack of a better argument, gold is money. In times of fear, people buy gold. I don’t know why, but human history has been the same for millennia. It probably won’t change this time.

How is gold as an investment? Let’s face it; there is no intrinsic value. For most of the last twenty years, it traded below the cost of production. A lot of the recent run-up, has been because of various ETFs buying gold. However, I think it will continue to go higher. People will look at how our government tends to the deficit, they’ll look at their bonds yielding very little and they’ll decide that it’s better to have an asset that yields nothing, but will protect them from a collapse. Why do people own bonds? Because they’re liquid, safe and offer some return on principal. Gold is liquid, offers no return on principal, but it is much safer than a treasury, or any instrument of any other government. For the first time in history, multiple world governments are facing unsustainable deficits. If it isn’t Americans who panic and send gold higher, it will be Europeans. Many of their government deficits are as bad as ours—and they don’t have the same access to the printing press that we do.

How should gold be valued? I think it should trade for a premium to the cost of producing it. Monetary and political inflation causes the cost of production to increase. I’d say that total production costs have increased 20% a year for the last five years. This is a big reason for the price rising. I think that production costs will continue to rise—hence the price of gold should increase—even if there isn’t incremental demand from investors fleeing to safety.

I realize that this is a political commodity. There is a lot of skepticism out there about gold. I see gold as an investment that has downside of 10-20% and likely upside of 50% from here in the next few years. However, if our government continues to act foolish, gold could go parabolic. I hope it’s a low probability event, but I wouldn’t be surprised if gold went up 5-fold in the next decade.

I’ve been a believer in gold for nearly a decade. However, I think now is the time to seriously think about it. Before, all these facts were hypothetical. Now our country really is seriously sliding into bankruptcy. The action in Greece really could be the tipping point that gets people interested in thinking about gold for protection. A very small percentage shift in world-wide asset allocation would have serious implications for gold.

There are many trades out there that can let you bet on the US defaulting. However, shorting bonds will cost you money until you are right. Buying CDS on the US government is stupid b/c they won’t actually default—they’ll print their way out of it. You can short the US dollar, but every other currency also has warts. I can see a scenario where a decade from now, it costs 10 EUR or 13 USD to buy a can of coke, and both currencies are at the same price compared to each other. I can think of no other way to protect yourself from a default besides gold. Maybe that’s why it keeps going higher?

There are guys who will talk about deflation. I do not think it is possible to have deflation as long as the government has a printing press. It really seems that all roads lead to inflation. Short deflationary periods like the fall of 2008, just lead to increased money printing afterwards. I do want to point out that if there is ever actually deflation, it would likely decrease the price of various base metals. When you look at miner’s announced cash cost, this figure often includes a very substantial credit for base metal revenue. Lower base metal prices, particularly copper, would quite significantly increase the cost of gold production. It’s a little appreciated fact, but most gold mines in the world are really copper mines that call themselves gold mines to get higher market multiples. Hence, deflation could potentially increase the price of gold because the cost of producing it would increase substantially.

I just think that the time for gold has come. I think it will continue to go up 10-20% a year as the cost of producing it goes higher. The downside is marginal as it likely will not trade significantly below the cost of production again. Finally, there is a very good chance that you can get a blow-off move in gold over the next decade where gold trades at a few times the cost of production. In the end, you own gold out of fear. You could have sat out the tech bubble in 1999. You’d be scared to sit out the gold bubble. What if all these crazy guys with guns and bomb shelters were right after all?