07/11/2018

July 11, 201808/11/2018

August 11, 2018Ever since Air Canada announced the termination of their Aeroplan agreement with Aimia (AIM – Canada) last year, I have suspected that this was a prelude to them eventually acquiring Aeroplan. I believed this due to simple math. It will cost Air Canada $200 to $400 per cardmember to organically build their own loyalty program. Aeroplan has 5 million cardmembers, hence trying to build it internally is a commitment of $1 to $2 billion—which would be foolish to undertake as Aeroplan was trading for a market cap of only $300 million when I wrote about it—plus you got a number of other valuable assets for free. Even more importantly, by purchasing Aeroplan, Air Canada would avoid the need to spend many years building a new Aeroplan internally.

Since the former board of Aimia was one of the most incompetent boards ever to oversee a large public company, Air Canada was well justified in thinking that if they wounded Aimia, the board would panic and fire-sell Aeroplan. For instance, they sold Nektar to Sainsbury for NEGATIVE $174 million. However, after shareholders rebelled at the AGM (I’m proud to have fired the first shot) and almost evicted the whole legacy board, Jeremy Rabe was made CEO. He’s the first competent person to ever run Aimia. Now, with 3 board seats held by adults and a new post-2020 plan for Aeroplan, Air Canada has realized that they missed their chance to steal Aeroplan on the cheap. Instead, they made a somewhat panicked public bid for the subsidiary.

For a year, I have repeatedly read stories about how when the Aeroplan agreement ends in 2020, there will be a run on the bank and Aimia will fail. However, no one has spoken about the fact that Aeroplan was responsible for purchasing more than 2 million seats on Air Canada flights during 2017. Aeroplan can shift these seats to any other airline by prioritizing the redemption pricing and display to customers. Without these 2 million seats, Air Canada is screwed—such is the nature of a fixed cost business where all your profits rely on your load factor. Aeroplan has always had the power here—Air Canada doesn’t. Air Canada has known this all along but played a game of chicken for the past year while they talked about building an internal loyalty program themselves. They’ve now shown their hand—they intend to buy Aeroplan. Who would ever want to join and work at this new internal program now, if Air Canada is going to purchase Aeroplan instead? You certainly aren’t going to get quality talent. I assume whoever was already hired is focused on calling headhunters as I write this. Air Canada is now stuck, they cannot attract the talent to build it internally, so they have to go ahead with their plan to purchase Aeroplan.

So, what will Air Canada pay for Aeroplan? Their offer of $250 million or $50 per cardholder is silly. I suspect they’ll be forced to pay a whole lot more and they now have a gun to their head as Aeroplan has officially said that it will migrate the business to be more of a diversified loyalty program, less focused on flight rewards, with an expanded airline partner network. Air Canada has to buy Aeroplan to maintain their load factor and I suspect they may be forced to pay somewhere north of $1 billion or $200 per card holder. At that price, it will still be immediately accretive to Air Canada and cheaper than them building it internally.

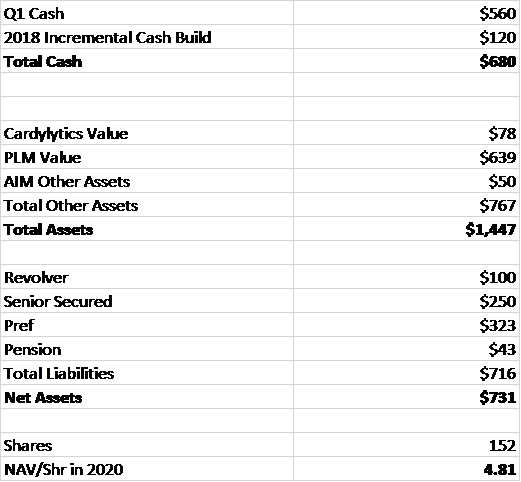

I posted this sum of the parts analysis in the past. I might as well update it for Q1 2018 numbers. The key is that at year-end 2018, you have almost $5.00 a share in value excluding Aeroplan. Since the shares have traded at a discount to this price (they still do), the market was telling you that Aeroplan had a negative perceived value—due to the risk of a run on the bank from redemptions. Now that Air Canada has plugged in a value of $250 million while absorbing all the risk of redemptions, we can say that the shares ought to be worth $1.65 more, or some total value in the mid $6’s. However, if Aeroplan is sold for $1 billion, that would add $6.62 in value and you get a price of over $11 per share. Somewhere between that range is where the shares ought to trade today as Aimia negotiates with Air Canada. Meanwhile, PLM ($100m estimated EBITDA at a 10x multiple adjusted for .765 CAD fx and 48.9% ownership = $639m value), the other key component of value will continue to grow rapidly and cash will accumulate to the balance sheet. Finally, what’s to say that $200 a cardmember is the right price to pay? If it costs $400 a cardmember to build this, why can’t Aeroplan be worth $2 billion?? That would still be less than 10 times stand-alone Aeroplan EBITDA.

Before Wednesday, this was all theoretical. Now it’s a hard fact. Air Canada needs Aeroplan and will likely pay a whole lot more than $250 million to buy it. The shares have not yet factored this in. If Aimia wasn’t such a large position for me, I’d be buying it hand over fist at today’s prices.