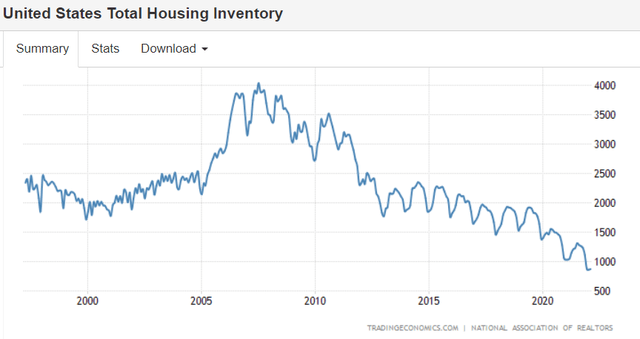

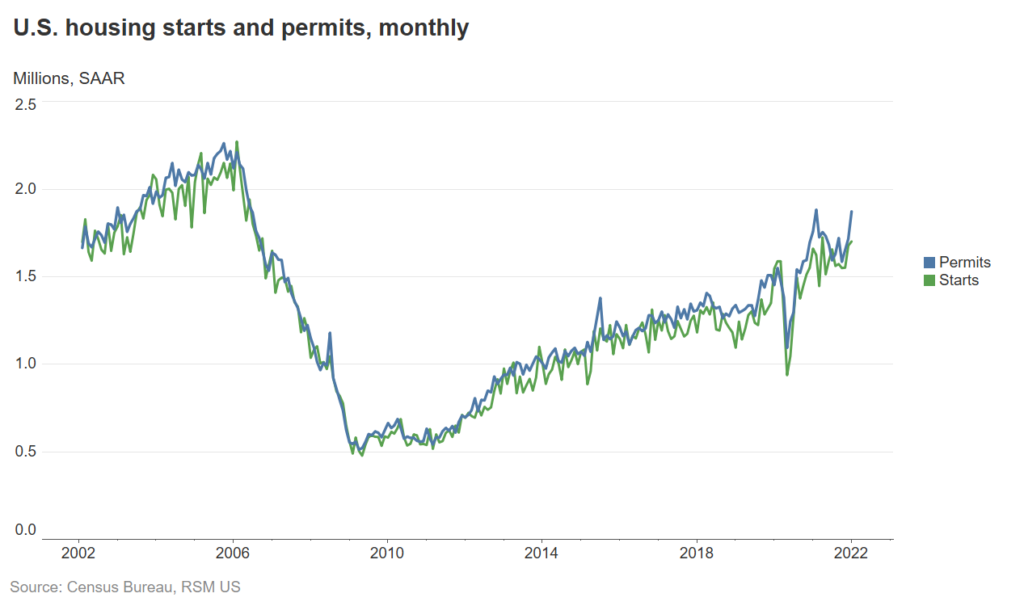

It is said that generals always fight the last war. I believe investors do the same, but with a greater sense of PTSD, combined with self-assurance. Often, investors cluster in groupthink, focused on narratives—completely ignoring facts. Nowhere does this appear more extreme than in the housing market. On one hand, you have everyone from homebuilders to the housing supply chain, to brokers saying that the market is absolutely raging hot. Then you have empirical data—look at the lack of for-sale inventory , despite an acceleration in housing starts. Look at the price of lumber that cannot seem to pull back or the increasing backlog for windows, siding, EWP and other components. The demand for new homes looks simply insatiable. Everyone, even sort of tangentially touching the industry, appear to recognize this—especially the buyers who are desperately bidding against dozens of other buyers to secure a home. Then, on the other hand, you have investors, eyeballing the 30-year mortgage rate, saying that none of this overwhelming evidence matters. Maybe the investors will get it right, but I think they are missing one of the great bull markets of this decade, at valuations that defy logic.

I like to keep concepts simple around here. Let’s do a thought experiment. Say there are 1000 buyers who can afford a home when a 30-year mortgage is at 3%. Say there are 800 buyers who can afford it at 4% and 600 who can afford it at 5%. Now, realize that none of this matters; because there are only 100 homes to fight for. This sums up the US housing market today.

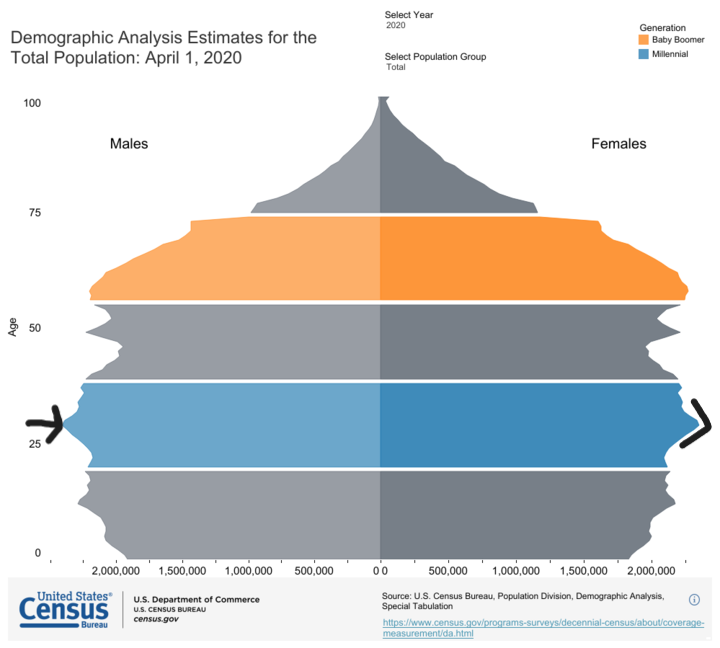

Let’s go back in time and diagnose the current aggressive case of investor housing-based PTSD. Back in 2005, the seeds of a housing crisis were sown. Banks were making NINJA loans (No Income, No Job, Approved!!). People were stretching to own properties using adjustable-rate mortgages, right into a rate-increase cycle. There were home-flippers everywhere, often on thin slivers of equity. Homebuilders were over-levered and building whole neighborhoods on spec. Meanwhile, much of this growth in new construction came at a funny trough in the growth of US family formation as Gen-X and Millennials pushed off having kids. It had all the makings of a crisis and then the bubble burst, it was gruesome.

Now, let’s fast forward to today. We are facing a demographic surge in new family formation as the echo-generation of the baby boomers is now having kids. People are fleeing increasingly violent and crazy cities. Californian refugees are flooding into low-tax states with a lower cost of living, along with better job prospects. Work-From-Home along with a surge in small online businesses have suddenly made it possible to work from anywhere. Meanwhile, I believe there’s a dearth of a few million homes if you plot population growth against home construction since the bust in 2009. It has all the makings of a long-term cycle as we are not only filling in the millions of missing homes, but also filling in the slack from inter-state migration—which will likely strand plenty of homes in places that become unattractive to live in.

Are mortgage rates up? Sure. Are homes expensive? You better believe it. But will a few hundred dollars a month in added mortgage costs stand in the way of a couple with a kid who can no longer live in a 1-bedroom apartment in NYC? They’ll save more than that just in state taxes if they move to Florida. Do you have any idea what $600,000 gets you in Texas? That won’t even get you a shack in California.

I want to make it very clear, real estate gets priced based on rental rates and cap rates. Rents have been skyrocketing because everyone seems to be getting massive raises. I don’t have a single friend who didn’t get a whopper in the past year. Offsetting this, cap-rates probably increase with higher interest rates. The interplay of these two—especially when you start at a low single-digit cap-rate is hard to predict. I have no strong view on property prices themselves. I want to make this very clear. If prices were to drop, especially in the states that are seeing massive out-migrations, I don’t think it changes my thesis one bit. In the end, I believe we need to be building well over 1 million new homes a year, for a decade into the future, just to keep pace with expected new family formation. I also believe we need to be building almost 2 million new homes a year if we want to make up for the lack of home construction over the past decade. If I know anything about our democracy, both parties will trip over themselves to give first-time homebuyers all sorts of stimmys to take the bite out of interest rates. I’m long volume, not price. Let me repeat that again; volume, not price.

But what about interest rates? Let’s look at the 1970s. They were a decade where home prices appreciated dramatically. Why? I think it is obviously because a home is a consumer durable, and the replacement cost increased with inflation. Have you ever looked at what interest rates did during the 1970s? They kept ramping—meanwhile it did little to slow down housing appreciation. Why? My view is it was because the baby boomers were having kids, they needed somewhere to put those kids and they all moved to the suburbs. They fled the increasingly chaotic cities. My father locked in a high-teens mortgage rate when he first bought his home. He had no choice.

Now, let’s think about this holistically. Home values should roughly track two variables; replacement cost and the rent vs. own decision. If we are in an inflationary environment, replacement cost and rental rates should appreciate rapidly. Meanwhile, I think there is a decent chance the government will subsidize your mortgage. Let’s say a mortgage costs you 5%, but the home appreciates at 20% a year. Do you want to lock in a 15% carry and do it with a few turns of leverage? Of course, you want to do that instead of renting. Even if mortgage rates were a few percent higher, who cares?? The positive carry is still there. In this thought experiment you want to put that trade on with every dollar you can put into it. When a decision is best for a family and the financials are appealing, people will figure out how to make it work. They’ll borrow from family members or cut expenses in places that they can cut. They’ll make sure that they build up equity.

Now, you can join the bears who are blathering on about mortgage rates, or you can look at the data. The data says to me that people are stampeding homebuilders for inventory. The industry commentary says the same thing. There is no supply and people are desperate for a home. Sometimes, investors get lost in their spreadsheets and models, they don’t go out there and observe—especially when the trends are happening far from Manhattan. This is what creates opportunity.

How am I playing it? I am fixated on volume over price, but I have ignored the homebuilders. I believe they have a capital-intensive business, beset by cost pressures and potential margin compression. At the core of the business, they own call options on lots. If I’m wrong on this thesis, those calls expire worthless, and their balance sheets get shredded. I want nothing to do with the homebuilding business. Instead, I’ve fixated on the housing supply chain, the guys who turn over inventory rapidly, the guys who can pass on price increases instantly, the guys who are earning stunningly high returns on capital employed. Amazingly, many of these companies trade for between two and four times the last twelve month’s cash flow (adjusted for working capital build). These companies know they’re mispriced and have massive buybacks in place. Some of these companies are shrinking their share counts by five to ten percent each quarter. What I find most interesting is that these companies are using cash flow to buy competitors, to consolidate the industry and increase market share and pricing. They’re not investing to build new facilities. Rather, they keep earning fatter margins in increasingly consolidated industries.

In summary, I’m tired of people asking why I have so much exposure to housing. I have now detailed my thinking for everyone. I sincerely hope that the sellers smack these names harder, it only makes the buybacks more accretive. I wrote a stunningly large number of May and June puts, I hope the bears keep growling about mortgage rates—I want to be assigned—I want to max out this position even further. Despite housing now being my largest exposure (it’s overtaken energy and uranium as I added aggressively into this dip), I want to press this bet even harder. It’s rare that you see a macro trend that is this good, with this strong of a tailwind, with this much hatred on the street, despite what I believe are insane valuations. I’m effectively long three trends that are rapidly accelerating; inflation, vote-buying stimmys and government insanity in blue states—leading to a refugee crisis for red states. These are all trends that I can put my back into. When they converge on one sector—the housing supply chain—I cannot help but get piggish.