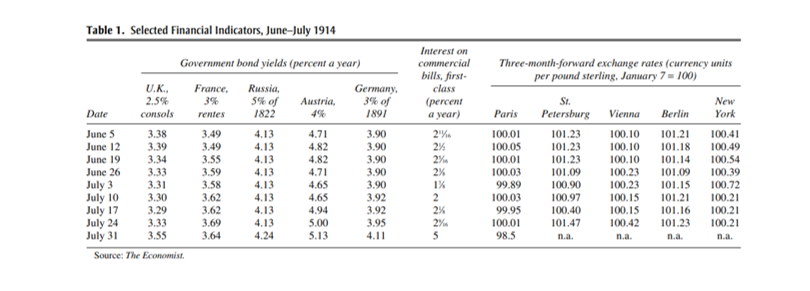

A few years back, I read an incredible white paper regarding investor complacency in the final weeks leading up to the First World War. Archduke Ferdinand was assassinated, global powers were trading demands, with the threat of war and investors didn’t care. As the crisis heated up and the armies began to mobilize, investors still were in a fantasy world. Back then, bonds were the primary liquid investor product and a potential war would weaken a government’s ability to redeem the bonds in gold—hence bond prices would collapse if there was a war. Four days before the war started, with armies mobilizing, outside of a few basis-point move in Austria, no one feared a crisis. Why were investors so complacent? There are plenty of reasons; there hadn’t been a European war in their lifetimes, economic conditions were reasonably robust and everyone trusted the politicians to sort things out.

I bring this all up as I sense a similar complacency surrounding the Coronavirus. Let me start by saying that I’m not a medical professional—I didn’t even get good grades in high-school biology. I have read my fair share of information by “so-called experts” but am well-aware that at this stage, most of what’s out there is just a bunch of theories using faulty Chinese data to arrive at a best guess for what will happen. Given the range of possible outcomes I have read, it is clear that there is absolutely zero consensus as to what will happen.

If diverging opinions on what will happen amongst “experts” sounds a lot like analyzing the stock market where the “experts” are also mostly wrong, then you’re paying attention to the potential for outlier events. With this virus, you need to gather your own information, understand it as best as possible and then try to reach an actionable hypothesis based on the fast-moving information.

My working hypothesis is that we’re likely dealing with a man-made pathogen that somehow escaped. I base this on the Chinese response to this thing—they aren’t treating this like a “normal flu.” Clearly, they know what it is, and they’re terrified. Then again, if you told me that the virus was caused by someone cooking up some cream of bat, with a side of pangolin, it wouldn’t change my outlook either. People seem to be getting bogged down with the conspiracy theories and not thinking big picture. Big picture is that there’s a virus, it seems highly contagious—especially during an extended incubation period without outward signs of disease and mortality is likely a lot higher than data shows. Part of the complacency amongst educated friends of mine, is that they’re acting like it’s a “normal flu” which it clearly isn’t.

I can spend the rest of this piece speaking about mortality data and RO values. The problem is that the data is poor, so I’m just guessing like everyone else. No one knows what will happen, but I want to make it clear that I’m not calling for a mass-extinction event of humanity, like many doomsayers out there. Humanity will beat this virus, much like we have beaten previous pandemics. We will contain the virus by having mandatory quarantines. We will close borders, cancel flights and stop all trade. Everyone will sit at home for a few months until the virus flames out—meanwhile, business activity effectively grinds to a halt.

Before this virus hit, we had a decade where every crisis was papered over with money printing. What happens if large portions of the globe are forced to take a multi-month quarantine? You can print all the money you want, if there’s literally zero business activity, monetary velocity collapses. You can ignore defaults and keep large firms afloat with bridge loans, but what happens to all the SMEs? Are they bailed out too? What happens to just-in-time supply chains? We’ve become so used to businesses having minimal inventory of parts and finished goods that even a minor disruption has dramatic effects—what happens then? Remember, you’re dealing with lots of highly-leveraged enterprises with high fixed costs and suddenly no revenue. What happens to credit metrics and debt covenants? What happens to consumer credit if there are mass-layoffs? I could go on and on. There’s a lot of what-if’s and no answers. We’re into uncharted territory here.

China’s reaction to the virus was to ignore it and hope it would go away, followed by disorganized panic. They put half their population under some form of quarantine and froze business activity. Everyone assumes that you can only do that in a top-down police state. The Italians are now doing something similar—will everyone else be forced to do the same? What are the investment implications? Everyone I know expects that they’ll just print money and solve the problem—what if this problem actually cannot be solved by money printing?

I am not here to tell you how to invest, most likely money printing props up the usual suspects and you want to increase your exposure there. Rather, I’m saying that until Friday, there was extreme complacency. I’m staring at my futures Sunday night and there’s a sudden awareness that things may have changed. If you aren’t at least thinking through how this virus effects each of your positions, you’re not taking this seriously. I’m not making a call to dump all positions, but I also don’t think this is the time for complacency. There was a window before WWI started where you could have adjusted your book, then suddenly, you couldn’t. Don’t miss the opportunity if there’s something you don’t want—especially as we’re a few ticks from all time highs in most asset classes.

Joking aside, this virus could be serious. Make sure to grab some N-100 masks while they’re still around and stockpile a few weeks of food + plenty of beer. Yeah, you probably won’t need it, but have you ever tried to shop for supplies 6 hours before the hurricane hits? I have and wouldn’t recommend it…

Is PE Having Its WeWork Moment…???

February 18, 2020Hospitality Goes No Bid…

March 8, 2020Extreme Complacency…

Warning: Trying to access array offset on value of type bool in /var/www/adventuresincapitalism.com/wp-content/themes/betheme/functions/theme-functions.php on line 1338

Warning: Trying to access array offset on value of type bool in /var/www/adventuresincapitalism.com/wp-content/themes/betheme/functions/theme-functions.php on line 1343

Warning: Trying to access array offset on value of type bool in /var/www/adventuresincapitalism.com/wp-content/themes/betheme/functions/theme-functions.php on line 1365

Warning: Trying to access array offset on value of type bool in /var/www/adventuresincapitalism.com/wp-content/themes/betheme/functions/theme-functions.php on line 1366

Warning: Trying to access array offset on value of type bool in /var/www/adventuresincapitalism.com/wp-content/themes/betheme/functions/theme-functions.php on line 1367

A few years back, I read an incredible white paper regarding investor complacency in the final weeks leading up to the First World War. Archduke Ferdinand was assassinated, global powers were trading demands, with the threat of war and investors didn’t care. As the crisis heated up and the armies began to mobilize, investors still were in a fantasy world. Back then, bonds were the primary liquid investor product and a potential war would weaken a government’s ability to redeem the bonds in gold—hence bond prices would collapse if there was a war. Four days before the war started, with armies mobilizing, outside of a few basis-point move in Austria, no one feared a crisis. Why were investors so complacent? There are plenty of reasons; there hadn’t been a European war in their lifetimes, economic conditions were reasonably robust and everyone trusted the politicians to sort things out.

I bring this all up as I sense a similar complacency surrounding the Coronavirus. Let me start by saying that I’m not a medical professional—I didn’t even get good grades in high-school biology. I have read my fair share of information by “so-called experts” but am well-aware that at this stage, most of what’s out there is just a bunch of theories using faulty Chinese data to arrive at a best guess for what will happen. Given the range of possible outcomes I have read, it is clear that there is absolutely zero consensus as to what will happen.

If diverging opinions on what will happen amongst “experts” sounds a lot like analyzing the stock market where the “experts” are also mostly wrong, then you’re paying attention to the potential for outlier events. With this virus, you need to gather your own information, understand it as best as possible and then try to reach an actionable hypothesis based on the fast-moving information.

My working hypothesis is that we’re likely dealing with a man-made pathogen that somehow escaped. I base this on the Chinese response to this thing—they aren’t treating this like a “normal flu.” Clearly, they know what it is, and they’re terrified. Then again, if you told me that the virus was caused by someone cooking up some cream of bat, with a side of pangolin, it wouldn’t change my outlook either. People seem to be getting bogged down with the conspiracy theories and not thinking big picture. Big picture is that there’s a virus, it seems highly contagious—especially during an extended incubation period without outward signs of disease and mortality is likely a lot higher than data shows. Part of the complacency amongst educated friends of mine, is that they’re acting like it’s a “normal flu” which it clearly isn’t.

I can spend the rest of this piece speaking about mortality data and RO values. The problem is that the data is poor, so I’m just guessing like everyone else. No one knows what will happen, but I want to make it clear that I’m not calling for a mass-extinction event of humanity, like many doomsayers out there. Humanity will beat this virus, much like we have beaten previous pandemics. We will contain the virus by having mandatory quarantines. We will close borders, cancel flights and stop all trade. Everyone will sit at home for a few months until the virus flames out—meanwhile, business activity effectively grinds to a halt.

Before this virus hit, we had a decade where every crisis was papered over with money printing. What happens if large portions of the globe are forced to take a multi-month quarantine? You can print all the money you want, if there’s literally zero business activity, monetary velocity collapses. You can ignore defaults and keep large firms afloat with bridge loans, but what happens to all the SMEs? Are they bailed out too? What happens to just-in-time supply chains? We’ve become so used to businesses having minimal inventory of parts and finished goods that even a minor disruption has dramatic effects—what happens then? Remember, you’re dealing with lots of highly-leveraged enterprises with high fixed costs and suddenly no revenue. What happens to credit metrics and debt covenants? What happens to consumer credit if there are mass-layoffs? I could go on and on. There’s a lot of what-if’s and no answers. We’re into uncharted territory here.

China’s reaction to the virus was to ignore it and hope it would go away, followed by disorganized panic. They put half their population under some form of quarantine and froze business activity. Everyone assumes that you can only do that in a top-down police state. The Italians are now doing something similar—will everyone else be forced to do the same? What are the investment implications? Everyone I know expects that they’ll just print money and solve the problem—what if this problem actually cannot be solved by money printing?

I am not here to tell you how to invest, most likely money printing props up the usual suspects and you want to increase your exposure there. Rather, I’m saying that until Friday, there was extreme complacency. I’m staring at my futures Sunday night and there’s a sudden awareness that things may have changed. If you aren’t at least thinking through how this virus effects each of your positions, you’re not taking this seriously. I’m not making a call to dump all positions, but I also don’t think this is the time for complacency. There was a window before WWI started where you could have adjusted your book, then suddenly, you couldn’t. Don’t miss the opportunity if there’s something you don’t want—especially as we’re a few ticks from all time highs in most asset classes.

Joking aside, this virus could be serious. Make sure to grab some N-100 masks while they’re still around and stockpile a few weeks of food + plenty of beer. Yeah, you probably won’t need it, but have you ever tried to shop for supplies 6 hours before the hurricane hits? I have and wouldn’t recommend it…