Over the years, I’ve spent less time talking to CEO and more time learning about industries. Let’s face it CEOs lie (compulsively). They only tell you the good news—or what they think you want to hear. If I have a strategy question, maybe I’ll let them humor me for 20 minutes about their 5-year plan. However, if I want to really learn something, I speak with the CFO. I have found them to be drier, most to the point and not as attuned to the nuances of shareholder interaction. They also tend to be closer to whatever discreet financial questions I may have.

This doesn’t mean that I’ve given up on company visits or the quarterly ordeal of earnings calls. I listen to hundreds of calls. I don’t want to just know what my positions are doing; I want to know what ALL of the competitors, customers and suppliers are doing. However, nothing beats the sort of knowledge you can gain at a large industry conference like ICR—which I just returned from.

I could save myself the travel time and listen to the presentations at home (with Reg FD, they’re almost all streamed live), however I go to conferences primarily for the group breakout sessions, usually attended by a handful of die-hard hedge fund PMs and analysts. This is where the gloves come off and people stop being friendly. You get to hear shorts try and embarrass CEOs, you hear guys threaten lawsuits and activism and you hear the guy next to you chime in with a quick footnote, “That asshole said the same thing last year and then did the opposite.” For 30 minutes, the wolf-pack attacks with rapid-fire questions and the CEOs are on the defensive. Along the way, I get to see what a half dozen knowledgeable investors are worried about and what I may have missed in my own due diligence. You can watch the CEOs squirm and guess if they’re lying or not. More importantly, you see which questions really frustrate them and which ones cause no concern. It’s two days of mayhem and a few dozen meetings. It may take me weeks to prepare for the meetings; yet, well-run conferences are always worth it.

Given how compact the meeting schedule is, you start to hear recurring themes;

-Low skilled labor cost is increasing much faster than the government’s statistics

-Transport cost is still high but moderating a bit

-Online models are difficult to implement and will have negative returns on capital for many years into the future

-Big investments will continue in IT anyway

-Omni-channel is the way to go

-Economy remains strong but there was a noticeable dip in December

At the same time, you notice which themes are missing this year;

-No talk of health care inflation

-Minimal talk of regulatory risk

However, the biggest theme I heard was related to on-shoring and abandoning China’s supply chain. Despite what politicians may want you to believe, this has actually been an ongoing trend for the last few years. As China gets wealthier, labor costs are increasing, leading unskilled production to cheaper countries or back to America where production can be automated. At the same time, due to supply chain complexity and the needs of just-in-time product, lead times and supply chains are shortening forcing production closer to America. However, Trump’s trade war has put this trend into hyper-speed.

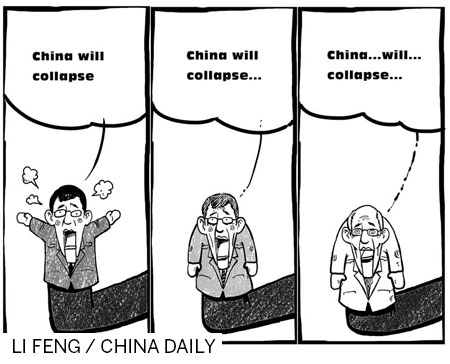

No one wants to risk paying tariffs and no one wants to be in a situation where a critical component can be banned and force an entire product’s re-design. The risks are just too high and Trump’s next moves are seen as too unpredictable. While no one is happy about impairing fixed infrastructure or dealing with the chaos of rapidly re-making a whole supply chain, Trump has taken a multi-year process and accelerated it into a few quarters. Dozens of companies spoke of going from 50-70% “at-risk to China,” to no China exposure in 6 months. That’s stunning rate of change. Once it is in motion, it won’t be reversed—no matter what agreement Trump can reach with Xi. I’m not smart enough to figure out all the second order effects of this change—however, I know who loses badly. There’s a reason that China’s manufacturing economy is collapsing. Look at the statistics—even the Chinese, who take an Elon Musk approach to statistical reporting, cannot fake a collapse in their export industries.

Why does this matter? I don’t see the Chinese government allowing their economy to simply unravel. In the longer run, the economy will have to shift towards a more services-oriented economy—however, this take time. Short term, the Chinese will go with Plan A, the only plan they seem to know—bridges to nowhere funded by risky loans to dubious SOEs, facilitated by lax government oversight and money printing. How do you play this? You own the stuff that goes into this infrastructure; commodities. You want coking coal, iron ore, copper and all the other components of heavy infrastructure. You want natural gas as LNG which will be the preferred fuel-source for this growth. The switch from coal to natural gas electrification certainly qualifies as a giant make-work program—with the added benefit that cleaner air means fewer citizen protests. Finally, you want to own the supply chain—the pipelines, rail and boats that will transport all this stuff.

The producers and suppliers of these assets have been sold off relentlessly over the past few months on the view that China’s economy is about to collapse—I think the sellers are wrong and the valuations are silly. I have been aggressively adding more exposure over the past two months.

In summary, there’s only so much you can learn by reading 10-K’s. To be successful as an investor, you need to get out, meet people, learn something new and question assumptions relentlessly. Investment conferences are great. My resolution for 2019 is to attend more conferences.

Disclosure: Funds that I manage are long various natural gas, coking coal producers and shipping companies

Scorpio Tankers

January 13, 2019The European (Dis)Union

January 24, 2019The View From ICR

Over the years, I’ve spent less time talking to CEO and more time learning about industries. Let’s face it CEOs lie (compulsively). They only tell you the good news—or what they think you want to hear. If I have a strategy question, maybe I’ll let them humor me for 20 minutes about their 5-year plan. However, if I want to really learn something, I speak with the CFO. I have found them to be drier, most to the point and not as attuned to the nuances of shareholder interaction. They also tend to be closer to whatever discreet financial questions I may have.

This doesn’t mean that I’ve given up on company visits or the quarterly ordeal of earnings calls. I listen to hundreds of calls. I don’t want to just know what my positions are doing; I want to know what ALL of the competitors, customers and suppliers are doing. However, nothing beats the sort of knowledge you can gain at a large industry conference like ICR—which I just returned from.

I could save myself the travel time and listen to the presentations at home (with Reg FD, they’re almost all streamed live), however I go to conferences primarily for the group breakout sessions, usually attended by a handful of die-hard hedge fund PMs and analysts. This is where the gloves come off and people stop being friendly. You get to hear shorts try and embarrass CEOs, you hear guys threaten lawsuits and activism and you hear the guy next to you chime in with a quick footnote, “That asshole said the same thing last year and then did the opposite.” For 30 minutes, the wolf-pack attacks with rapid-fire questions and the CEOs are on the defensive. Along the way, I get to see what a half dozen knowledgeable investors are worried about and what I may have missed in my own due diligence. You can watch the CEOs squirm and guess if they’re lying or not. More importantly, you see which questions really frustrate them and which ones cause no concern. It’s two days of mayhem and a few dozen meetings. It may take me weeks to prepare for the meetings; yet, well-run conferences are always worth it.

Given how compact the meeting schedule is, you start to hear recurring themes;

-Low skilled labor cost is increasing much faster than the government’s statistics

-Transport cost is still high but moderating a bit

-Online models are difficult to implement and will have negative returns on capital for many years into the future

-Big investments will continue in IT anyway

-Omni-channel is the way to go

-Economy remains strong but there was a noticeable dip in December

At the same time, you notice which themes are missing this year;

-No talk of health care inflation

-Minimal talk of regulatory risk

However, the biggest theme I heard was related to on-shoring and abandoning China’s supply chain. Despite what politicians may want you to believe, this has actually been an ongoing trend for the last few years. As China gets wealthier, labor costs are increasing, leading unskilled production to cheaper countries or back to America where production can be automated. At the same time, due to supply chain complexity and the needs of just-in-time product, lead times and supply chains are shortening forcing production closer to America. However, Trump’s trade war has put this trend into hyper-speed.

No one wants to risk paying tariffs and no one wants to be in a situation where a critical component can be banned and force an entire product’s re-design. The risks are just too high and Trump’s next moves are seen as too unpredictable. While no one is happy about impairing fixed infrastructure or dealing with the chaos of rapidly re-making a whole supply chain, Trump has taken a multi-year process and accelerated it into a few quarters. Dozens of companies spoke of going from 50-70% “at-risk to China,” to no China exposure in 6 months. That’s stunning rate of change. Once it is in motion, it won’t be reversed—no matter what agreement Trump can reach with Xi. I’m not smart enough to figure out all the second order effects of this change—however, I know who loses badly. There’s a reason that China’s manufacturing economy is collapsing. Look at the statistics—even the Chinese, who take an Elon Musk approach to statistical reporting, cannot fake a collapse in their export industries.

Why does this matter? I don’t see the Chinese government allowing their economy to simply unravel. In the longer run, the economy will have to shift towards a more services-oriented economy—however, this take time. Short term, the Chinese will go with Plan A, the only plan they seem to know—bridges to nowhere funded by risky loans to dubious SOEs, facilitated by lax government oversight and money printing. How do you play this? You own the stuff that goes into this infrastructure; commodities. You want coking coal, iron ore, copper and all the other components of heavy infrastructure. You want natural gas as LNG which will be the preferred fuel-source for this growth. The switch from coal to natural gas electrification certainly qualifies as a giant make-work program—with the added benefit that cleaner air means fewer citizen protests. Finally, you want to own the supply chain—the pipelines, rail and boats that will transport all this stuff.

The producers and suppliers of these assets have been sold off relentlessly over the past few months on the view that China’s economy is about to collapse—I think the sellers are wrong and the valuations are silly. I have been aggressively adding more exposure over the past two months.

In summary, there’s only so much you can learn by reading 10-K’s. To be successful as an investor, you need to get out, meet people, learn something new and question assumptions relentlessly. Investment conferences are great. My resolution for 2019 is to attend more conferences.

Disclosure: Funds that I manage are long various natural gas, coking coal producers and shipping companies